CMS Energy Declares Quarterly Dividend on Cumulative Redeemable Perpetual Preferred Stock

CMS Energy Declares Quarterly Dividend on Cumulative Redeemable Perpetual Preferred Stock

Preferred stock is often compared to bonds because both may offer recurring cash distributions. However, as there are many differences between stocks and bonds, there are differences with preferred equity as well. Preference preferred stock is considered the next tier of stock in terms of prioritization. Though it falls behind prior preferred stock, preference preferred stock often has greater priority compared to other issuances of preferred stock.

Sections

Ask a Financial Professional Any Question

Once the exchange has occurred, the investor has relinquished its right to trade and cannot convert the common shares back to preferred shares. Convertible preferred stock usually has predefined guidance on how many shares of common stock it can be exchanged for. Like bonds, preferred stocks are rated by the major credit rating companies, such as Standard & Poor’s and Moody’s. The seniority of preferreds applies to both the distribution of corporate earnings (as dividends) and the liquidation of proceeds in case of bankruptcy. With preferreds, the investor is standing closer to the front of the line for payment than common shareholders, although not by much.

Convertible

Though there are sacrifices for this right, preferred stock are simply a different vehicle for owning part of a business. Institutions are usually the most common purchasers of preferred stock, especially during the primary distribution phase. This is due to certain tax advantages that are available to them but that are not available to individual investors. Because these institutions buy in bulk, preferred issues are a relatively simple way to raise large amounts of capital. Information about a company’s preferred shares is easier to obtain than information about the company’s bonds, making preferreds, in a general sense, perhaps more liquid and easier to trade. The low par values of the preferred shares also make investing easier, because bonds (with par values around $1,000) often have minimum purchase requirements.

Reason to Treat Preferred Stock As Debt Rather Than Equity

- CPS provides a stable income stream to investors and priority in dividend payments and liquidation preference.

- Preferred shares may be callable where the company can demand to repurchase them at par value.

- If a company guarantees dividends of $10 per preference share but cannot afford to pay for three consecutive years, it must pay a $40 cumulative dividend in the fourth year before any other dividends can be paid.

- What this means is that you’re not investing for growth necessarily, but rather for the income.

However, it’s important to note that dividends on preferred stock are not guaranteed and can be affected by the financial health of the issuing company. These features play a pivotal role in determining the attractiveness of preferred stock to investors and its place within their portfolios. Investors should also be aware of the potential drawbacks of CPS, such as limited voting rights and interest rate risk, and weigh them against the potential benefits of the investment.

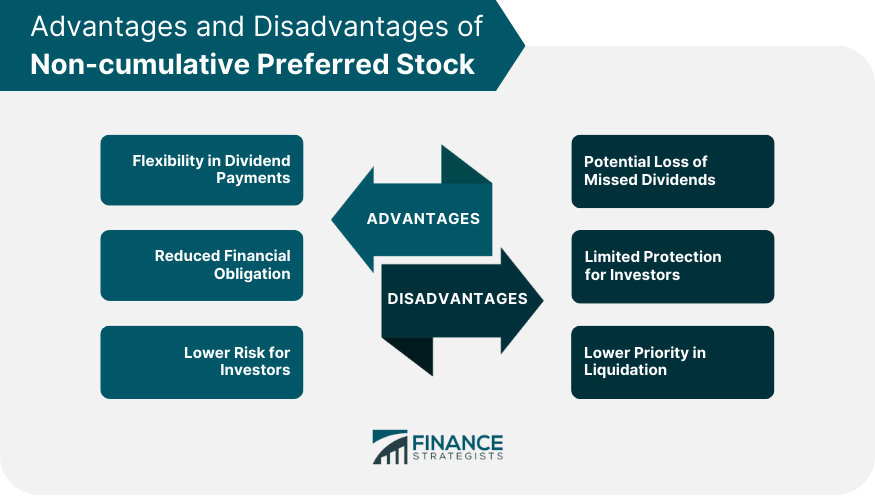

However, for investors, the fixed dividend payments may not keep pace with inflation or changes in interest rates. Cumulative Preferred Stock is a type of security that offers a fixed dividend rate, priority in dividend payments and liquidation preference, and potential for capital appreciation. Non-cumulative preferred stock does not issue any omitted or unpaid dividends. If the company chooses not to pay dividends in any given year, the shareholders of the non-cumulative preferred stock have no right or power to claim such forgone dividends at any time in the future. These dividend payments are guaranteed but not always paid out when they are due.

How Does a Preferred Security Work?

Namely, preferred stock often possess higher dividend payments, and a higher claim to assets in the event of liquidation. In addition, preferred stock can have a callable feature, which means that the issuer has the right to redeem the shares at a predetermined price and date as indicated in the prospectus. In many ways, preferred stock share similar characteristics to bonds, and because of this are sometimes referred to as hybrid securities. But if a company misses dividend payments on preferred stock, investors lose out on that income (unless they own merging math and music in an accounting firm). This says that if any dividend payments have been skipped, they must be paid out to preferred shareholders before common shareholders are paid any current dividends. Cumulative dividend provisions are intended to give preferred shareholders confidence that they’ll receive the stated return on their investments.

Thomas’ experience gives him expertise in a variety of areas including investments, retirement, insurance, and financial planning. Adam Hayes, Ph.D., CFA, is a financial writer with 15+ years Wall Street experience as a derivatives trader. Besides his extensive derivative trading expertise, Adam is an expert in economics and behavioral finance. Adam received his master’s in economics from The New School for Social Research and his Ph.D. from the University of Wisconsin-Madison in sociology. He is a CFA charterholder as well as holding FINRA Series 7, 55 & 63 licenses. He currently researches and teaches economic sociology and the social studies of finance at the Hebrew University in Jerusalem.

Preferreds, which offer income potential, are securities that are generally considered hybrid investments, meaning they share characteristics of both stocks and bonds. They can offer more predictable income than do common stocks and are typically rated by the major credit rating agencies. Yet, because preferred shareholders have lower priority in the capital structure as compared to bondholders, the ratings on preferred shares are generally lower than the same issuers’ bonds. Although, the yields on preferreds typically are above those of same issuers’ bonds to account for the higher credit risk.

This means that a share of cumulative preferred stock must have all accumulated dividends from all prior years paid before any other lower-tier share can receive dividend payments. It’s also important to mention that some, but not all, cumulative preferred stocks have additional provisions to compensate shareholders if preferred dividends are suspended. For example, some preferred stocks require accumulated dividends to be repaid with interest.