Replacement Cost Method Business Valuation Vocab, Definition, Explanations Fiveable

Replacement Cost Method Business Valuation Vocab, Definition, Explanations Fiveable

CoreLogic continually monitors changing market conditions throughout the U.S. and Canada and makes appropriate adjustments for these situations when necessary. Replacement cost is a common term used in insurance policies to cover damage to a company’s assets. The definition is critical, since the insurer is committing to pay the insured entity for the replacement cost of covered assets, if those assets are damaged or destroyed. The main limitation with replacement Cost Accounting is that it only works well under certain circumstances, such as when there has been no capital gains tax and indexation has not played a part in any real property investment decisions. It is also important to note that replacement Cost Accounting should not be used for intangible assets. Rca requires the appropriate index numbers to be used when replacing old assets, which means it does not result in any loss.

Sections

How Do Insurance Companies Calculate Replacement Cost?

The price at which an asset would sell in a competitive auction setting, assuming both buyer and seller are knowledgeable, willing, and under no undue pressure. This team of experts helps Finance Strategists maintain the highest level of accuracy and professionalism possible. Our team of reviewers are established professionals with decades of experience in areas of personal finance and hold many advanced degrees and certifications.

Great! The Financial Professional Will Get Back To You Soon.

The straight-line method divides the cost over the useful life for annual depreciation, while the accelerated method front-loads depreciation costs. The resulting disparity between the present value of cash inflows and outflows becomes the crucial factor in the decision-making process. Despite the method used, the total depreciation expense over the asset’s useful life remains constant. A business then evaluates the cash outflow for the purchase alongside the cash inflows generated from the heightened productivity of utilizing a new, more efficient asset. In the process of identifying assets that require replacement and determining their values, companies employ the net present value method.

Company

- Replacement cost is a term referring to the amount of money a business must currently spend to replace an asset like a fixture, a machine, a vehicle, or an equipment, at current market prices.

- Under this approach, they anticipate when their key assets are going to require replacement, and then set up a plan to set aside the necessary funds for them, so that they can be replaced in an orderly fashion.

- Replacement Cost Accounting is an improvement over current purchase power parity (cpp).

- The replacement cost accounting (RCA) technique is an improvement over current purchase power (CPP).

- It is not necessary that the market value and replacement cost of a building are identical, as the two are distinctly different approaches to valuing a property using real estate data analytics.

Consider a manufacturing company, ABC Inc., that owns a fleet of delivery trucks used for transporting goods to customers. To assess the current value of its fleet, ABC Inc. decides to calculate the replacement cost of its trucks based on current market prices. The replacement cost method is a valuation approach that estimates the cost to replace an asset with a new one of similar kind and quality, adjusting for physical depreciation. This method is particularly useful in determining the value of tangible assets and can be employed when market data is scarce. By focusing on the cost required to recreate the asset rather than its current market value, this method provides a practical perspective on asset valuation, especially in contexts where fair market value assessments are difficult to obtain. If a company’s asset has a historical cost that differs widely from its current market price, the replacement cost might increase the value of the company.

All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. CPP suffers from the problem that it does not consider the individual price index related to the particular assets of a company. Shaun Conrad is a Certified Public Accountant and CPA exam expert with a passion for teaching. After almost a decade of experience in public accounting, he created MyAccountingCourse.com to help people learn accounting & finance, pass the CPA exam, and start their career.

To Ensure One Vote Per Person, Please Include the Following Info

Therefore, the replacement cost of each truck is $60,000, reflecting the amount ABC Inc. would need to spend to acquire a new truck with similar capabilities. The insurance company’s primary function is to evaluate whether the decision of replacement is better than repair and maintenance. It is also vital for a company to correctly calculate the depreciation since it will have a significant impact on the decision to continue the old asset or replace it with a new one.

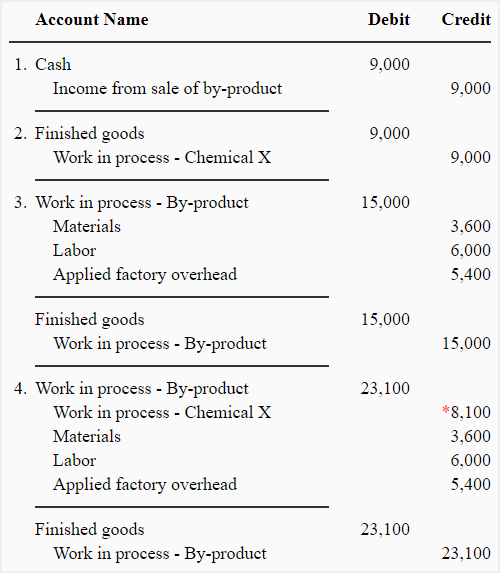

The where do dividends appear in the financial statements is an accounting approach that values assets based on the cost to replace them with new ones at current market prices. This method is particularly useful for evaluating the worth of by-products, as it considers the expenses involved in producing or acquiring replacements rather than their historical costs. By focusing on current values, this method helps businesses make informed decisions regarding resource allocation and pricing strategies.

The company adjusts these cash flows to present value using the discount rate, and if the net total of present values is positive, it proceeds with the purchase. Accountants, who rely on depreciation to allocate the cost of an asset over its useful life, also commonly use replacement costs. Insurance companies routinely utilize replacement costs to assess the value of insured items. In this situation, it would cost the company $23,000 to purchase a similar asset to the one they current have in order to replace it.